Currently, the United States represents the most significant stock market globally, with its overall market value accounting for more than 50% of the global stock market and hosting the world’s most important companies.

In the past, the most significant stock market crashes have seen declines of up to around -50%, and this is just for overall indices. During these crashes, many weaker companies have seen their stock prices plummet by over -80%, leading in some cases to insolvency and closure.

Each stock market crash has led to some people losing everything, while others have seized the opportunity to buy at the bottom, amassing considerable wealth. But what exactly constitutes a stock market crash?

What mental preparation and measures should one take in the face of a stock market crash?

In this article, I will take you through a review of seven major stock market crashes in the U.S. stock market, the world’s largest, over the past century.

Stock Market Crash 1: The Great Depression of 1929

Start Date: October 1929

End Date: March 1933 (Duration: 3 years and 6 months)

Recovery to Previous High: September 1954 (Duration: 25 years)

Maximum Drop: -86.0%

The above data is calculated based on the monthly average closing price of the S&P 500 Index.

The Wall Street Crash of 1929 is considered the most severe stock market crash in American history, not only in terms of the extent of the decline and its impact but also in its duration, leading to the economic depression that lasted for over a decade.

During the 1920s, the United States experienced the “Roaring Twenties,” a period of economic prosperity and a bullish stock market, with rampant speculative trading. People thought it was too easy to make money from the stock market, and nobody cared about the risks.

From 1923 to 1929, the Dow Jones Industrial Average rose fivefold, attracting many speculators who borrowed money to buy stocks.

By March 1929, the amount of stock brokerage loans to small investors was already more than two-thirds of the stock market’s value, with the total amount of loans exceeding $8.5 billion, more than the total amount of U.S. currency in circulation, which was astonishing. Speculators’ trading continued to push stock prices higher, disconnecting them from the fundamentals and eventually forming an economic bubble that led to the crash.

On October 28, 1929, the Dow Jones Industrial Average plunged 13% in one day, and the decline continued the next day, dropping another 12% on October 29. This downward trend lasted for more than three years, wiping out about 80% of the stock market’s value.

In this crash, over 90% of Wall Street bankers went bankrupt, thousands of lenders were in dire straits, and the rapid fall in stock prices led to business closures and layoffs, with unemployment rates reaching 25%. Unemployment led to reduced consumer spending, plunging the economy into a negative cycle of depression.

Additionally, the stock market crash caused many banks to collapse due to unrecoverable loans, and as banks tightened their lending criteria, many small and medium-sized businesses couldn’t secure loans. The U.S. economy entered the Great Depression, which lasted for a decade.

This stock market crash also marks the longest period of stock market stagnation; if someone had bought stocks at the peak in 1929 and held onto them, it would have taken 25 years to recover their initial investment.

Government Market Rescue Actions:The U.S. government learned from the experience of 1929 and intervened in the market immediately after the crash to prevent it from escalating into a more severe economic crisis. The main actions taken were as follows:

1. On October 20, before the U.S. stock market opened, an emergency statement was issued, expressing support for commercial banks to continue lending to stock traders. The Federal Reserve assured the market of providing sufficient liquidity. The U.S. President at the time, Ronald Reagan, also made a statement to stabilize public sentiment: “This stock market crash is not in line with the healthy economic condition of the United States. The U.S. economy is very stable.”

2. Provided funds to several large companies to enable them to buy back their stocks.

3. Coordinated exchange rate policies with other major countries to stabilize the U.S. dollar exchange rate and prevent capital outflow.

4. Significantly lowered interest rates.

5. Interrupted the vicious cycle generated by program trading and introduced a circuit breaker mechanism. When stock prices exhibit abnormal fluctuations, trading can only occur within the price range set by the circuit breaker.: Initially, the U.S. government adopted a laissez-faire economic policy, so it did not undertake timely and specific market rescue actions during this stock market crash. This inaction ultimately led to the disaster. However, after the crash, the U.S. government began to reflect on the causes of the crash and gradually introduced 《the Glass-Steagall Act》to reform the banking system and control speculation. It also enacted the Securities Exchange Act and established the U.S. Securities and Exchange Commission (SEC). These measures finally stabilized the U.S. stock market and the economy.

Stock Market Crash 2: The Bear Market within a Bear Market of 1937

Start Date: March 1937

End Date: August 1942 (Duration: 5 years and 2 months)

Recovery to Previous High: August 1946 (Duration: 9 years and 2 months)

Maximum Drop: -57.6%

The above data is calculated based on the monthly average closing price of the S&P 500 Index.

The 1937 stock market crash can be seen as a continuation of the 1929 crash, yet it was still devastating in its own right.

It ranks second in terms of decline and had the longest duration, taking a total of 5 years to return to a bull market.

Following the Wall Street Crash of 1929, the U.S. stock market began to rise in 1933, leading people to mistakenly believe that the bear market had ended. Market confidence began to recover, and the stock market increased nearly fourfold, reaching its peak in March 1937.

With the onset of World War II, Europe fell into large-scale warfare, Japan stirred up conflicts in Asia, and continuous scandals emanated from Wall Street. Within a year, the stock market plummeted by 50%, and the decline continued for five years. It took a total of 9 years for the market to recover to its previous high.

This was a time when the American people experienced extreme highs and lows again, thinking the bear market was over, not realizing that a bigger bear market was yet to come.

Stock Market Crash 3: The 1973 Oil Crisis

Start Date: January 1973

End Date: September 1974 (Duration: 1 year and 9 months)

Recovery to Previous High: July 1980 (Duration: 7 years and 7 months)

Maximum Drop: -46.3%

The above data is calculated based on the monthly average closing price of the S&P 500 Index.

In 1973, the post-war era’s most severe economic crisis occurred, also known as the world’s second economic crisis. During this crisis, the stock market plunged over 40% and remained in a prolonged bear market. The main reasons for the downturn in the U.S. stock market were economic recession and accelerated inflation, with the outbreak of the oil crisis further exacerbating the overall situation.

The United States Industrial Production Index’s year-over-year growth rate peaked at the end of 1972 and began to decline in 1973. Additionally, the government’s massive fiscal deficit and credit expansion caused inflation to soar.

To curb inflation, the Federal Reserve embarked on aggressive interest rate hikes, raising rates seven times within a year by August 1973. In October of the same year, amid the shock of the oil crisis, the United States experienced its most severe post-war economic crisis.

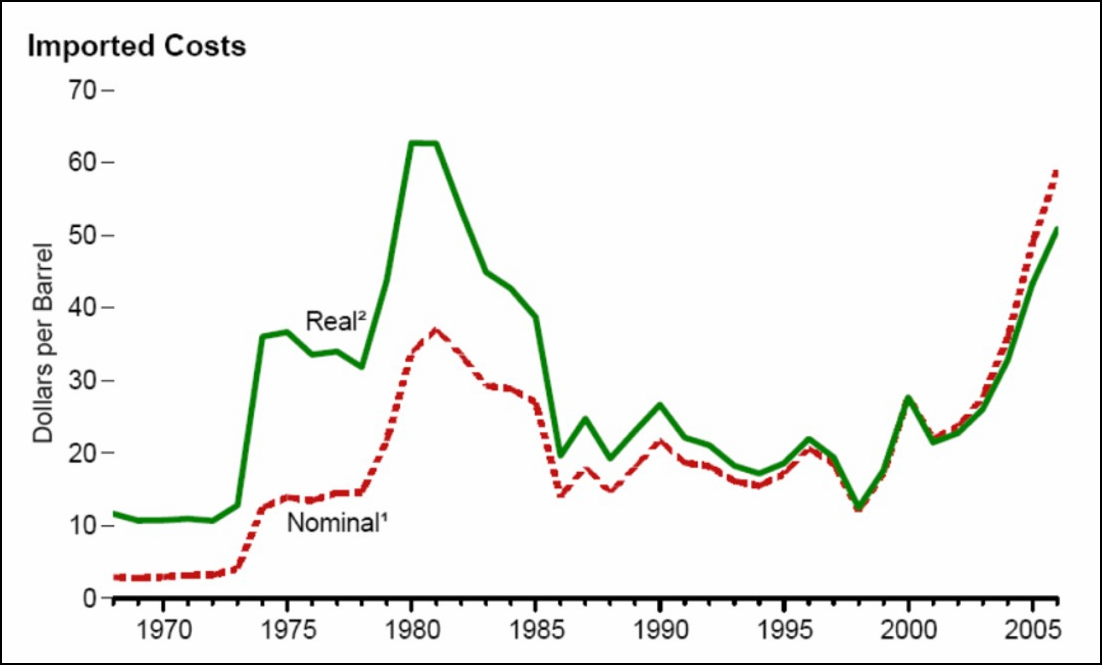

According to the World Bank’s statistics, the price of crude oil in September 1973 was $2.7 per barrel, which rose to $13 per barrel by January 1974, nearly a fivefold increase in a few months. The stock market fell nearly half in just over a year.

In 1975, the U.S. unemployment rate reached 9.2%, and the inflation rate climbed to 12%. The economic situation only began to slowly improve in 1976.

The cause of this stock market crash in the U.S. was not due to speculative trading like in 1929 but rather was driven by economic factors and inflation, with the oil crisis exacerbating its decline.

This crisis had a significant impact, with major global stock markets experiencing notable declines. The largest drop was in Hong Kong, where the Hang Seng Index fell 91.5% from its highest point in 1973 to its lowest in 1974.

Stock Market Crash 4: Black Monday of 1987

Start Date: October 1987

End Date: December 1987 (Duration: 3 months)

Recovery to Previous High: January 1989 (Duration: 1 year and 4 months)

Maximum Drop: -30.1%

The above data is calculated based on the monthly average closing price of the S&P 500 Index.

The infamous Black Monday on Wall Street occurred on Monday, October 19, 1987, when the Dow Jones Industrial Average plunged 22.62%, surpassing the 1929 record, equivalent to a market value loss of over $500 billion, nearly one-eighth of the U.S. Gross Domestic Product at the time.

In the early 1980s, the U.S. economy was thriving, and the stock market experienced several years of a bull run. By 1987, the Federal Reserve was continuously raising interest rates. However, due to pessimistic future economic expectations, coupled with tensions in the Middle East, anticipated devaluation of the dollar, and the cancellation of tax benefits for corporate mergers and acquisitions, the U.S. stock market began to correct. Finally, on Monday, October 19, 1987, the Dow Jones Industrial Average suddenly plummeted, closing with a 22.62% drop, the largest single-day decline in U.S. history.

Program trading accelerated this decline, as computer trading programs were set to sell stocks upon seeing a price drop. This selling then caused further price drops, leading to a vicious cycle.

In the following days, the dollar was sold off and significantly devalued. On October 26, the Dow fell another 8.03%, and stock markets around the world were also affected and suffered losses.

This was a globally impactful stock market crash, with total losses in major world stock markets amounting to $1.792 trillion, equivalent to five times the direct and indirect economic losses of World War I.

Fortunately, with past experience, the U.S. government intervened promptly to prevent the situation from evolving into an economic crisis, and the stock market returned to its previous high in just 1 year and 4 months.

Government Market Rescue Actions:

The U.S. government learned from the experience of 1929 and intervened in the market immediately after the crash to prevent it from escalating into a more severe economic crisis. The main actions taken were as follows:

1. On October 20, before the U.S. stock market opened, an emergency statement was issued, expressing support for commercial banks to continue lending to stock traders. The Federal Reserve assured the market of providing sufficient liquidity. The U.S. President at the time, Ronald Reagan, also made a statement to stabilize public sentiment: “This stock market crash is not in line with the healthy economic condition of the United States. The U.S. economy is very stable.”

2. Provided funds to several large companies to enable them to buy back their stocks.

3. Coordinated exchange rate policies with other major countries to stabilize the U.S. dollar exchange rate and prevent capital outflow.

4. Significantly lowered interest rates.

5. Interrupted the vicious cycle generated by program trading and introduced a circuit breaker mechanism. When stock prices exhibit abnormal fluctuations, trading can only occur within the price range set by the circuit breaker.

Stock Market Crash 5: The 2000 Dot-Com Bubble

Start Date: September 2000

End Date: February 2003 (Duration: 2 years and 6 months)

Recovery to Previous High: May 2007 (Duration: 6 years and 9 months)

Maximum Drop: -47.4%

The above data is calculated based on the monthly average closing price of the S&P 500 Index.

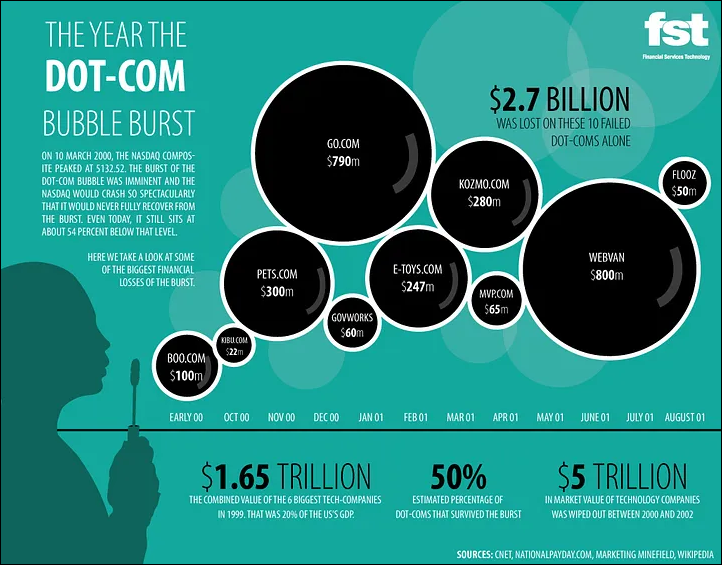

The dot-com bubble crisis of 2000 is also a well-known stock market crash, primarily caused by the bubble in internet companies, significantly impacting the NASDAQ index, hence often referred to as the NASDAQ crash.

In the late 1990s, with advancements in computer technology, an increasing number of high-tech stocks were listed on the NASDAQ exchange. High-tech stocks often implied high price-to-dream ratios, meaning that due to the inability to profit or incur losses in the short term, it was difficult to calculate the price-to-earnings ratio. However, the public held high hopes for the products being developed by these companies.

As a result, a large number of internet concept companies were hyped, with absurd valuations commonplace. In 1995, the NASDAQ index broke 1,000 points, and by March 2000, it reached a new high of 5,048.62 points. However, following the burst of the dot-com bubble, the NASDAQ index plummeted to 1,172 points in September 2002, a decline of 77%. Most of the hyped internet concept companies also disappeared.

After the burst of this bubble, dot-com companies successively burned through their funds, with the majority ending in bankruptcy or being acquired. Only a few companies survived, such as the well-known eBay and Amazon.

This crisis wiped out approximately $5 trillion in market value from the IT industry, greatly impacting it, while other industries were relatively less affected. Hence, the decline in the S&P 500 index was not as severe as that of the NASDAQ.

Stock Market Crash 6: The 2007 Subprime Crisis

Start Date: December 2007

End Date: March 2009 (Duration: 1 year and 4 months)

Recovery to Previous High: January 2013 (Duration: 5 years and 2 months)

Maximum Drop: -55.2%

The above data is calculated based on the monthly average closing price of the S&P 500 Index.

The 2007 subprime mortgage crisis began with the bankruptcy announcement of New Century Financial Corporation, the second-largest subprime mortgage company in the U.S. The crisis spread from the real estate market to the credit market, eventually leading to a global financial crisis, known as the 2008 Financial Tsunami.

After the dot-com bubble burst in 2000, the Federal Reserve lowered interest rates multiple times from 2000 to 2003, leading to a surge in both the housing and stock markets. The U.S. real estate market was booming, and even people with poor credit could obtain money through subprime loans.

Banks lent money to these individuals with poor credit and then packaged these loans into derivative financial products, selling them to other financial institutions or investors.

Moreover, credit rating agencies did not objectively rate these bonds and instead rated these high-risk bonds as AAA.

After 2004, the U.S. entered a cycle of interest rate hikes, raising the benchmark rate to over 5% by 2006. This caused a significant rise in loan interest rates, increasing the repayment pressure on the public and leading to a downturn in the housing market. As house prices began to fall, there was a massive default on subprime loans, and the securities packaged with these loans lost their value.

In December 2007, New Century Financial Corporation, the second-largest subprime mortgage company in the U.S., declared bankruptcy.

The crisis culminated in September 2008, with Fannie Mae and Freddie Mac, two major housing mortgage institutions, taken over by the government. Lehman Brothers, an investment banking giant with a century-long history, filed for bankruptcy protection, Merrill Lynch was acquired by Bank of America, and a series of financial institutions were on the brink of collapse, leading to a credit crunch and a global financial crisis that caused a significant drop in the stock market. The S&P 500 Index lost about 50% of its market value.

The crisis most heavily impacted financial institutions due to the interrelated transactions among them, creating unimaginable chain reactions. Following Lehman Brothers’ bankruptcy, many financial institutions faced either collapse or acquisition. Even Citibank’s stock price dropped to $1. Financial stocks became a hot potato that everyone wanted to get rid of.

The collapse of the financial system had a tremendous impact on the overall economy. The tightening of loans led to reduced investment by businesses and decreased consumer spending, perpetuating a negative economic cycle. In February 2009, the U.S. unemployment rate climbed to 8.1%, the highest in 26 years.

Government Market Rescue Actions:

During the financial crisis, the United States federal government promptly implemented measures to rescue the market. Its actions included:

1. Taking over Fannie Mae and Freddie Mac and assisting other financial institutions such as AIG, Citigroup, and others.

2. Adopting a quantitative easing monetary policy, continuously lowering interest rates. By December 2008, the target range for the federal funds rate was set at 0% to 0.25%.

3. Providing short-term loans to banks and offering emergency liquidity support.

Stock Market Crash 7: 2020, COVID-19

Start Date: March 5, 2020

End Date: March 23, 2020 (lasting 19 days)

Time to Recover to Previous High: June 3, 2020 (lasting 90 days)

Maximum Decline: -33.8%

The above data is calculated using the monthly average closing price of the S&P 500 index.

In 2020, due to COVID-19, the U.S. stock market experienced four circuit breakers within 10 days, an unprecedented event in history. However, the subsequent rapid rebound caught many investors off guard, ending the downturn in just 19 days.

On January 18, 2020, COVID-19 erupted in Wuhan, China. Mainland China initiated comprehensive control measures, impacting the stock market. On February 26, 2020, the number of confirmed cases outside mainland China exceeded those within, confirming the global spread. On March 6, 2020, Saudi Arabia, an oil giant, failed to reach an agreement with Russia in oil production negotiations. In retaliation, Saudi Arabia significantly increased oil production. On March 9, 2020, international oil prices plummeted by 30%, dealing a severe blow to the U.S. oil industry. This triggered a circuit breaker as the Dow Jones Industrial Average dropped nearly 8% on the same day.

Subsequently, on March 11, 2020, the World Health Organization declared COVID-19 a “global pandemic,” causing another sharp decline in global stock markets. Governments worldwide responded by announcing measures such as interest rate cuts to increase liquidity.

Despite the swift recovery of the U.S. stock market to its previous high within three months, setting subsequent historical highs, the disconnect between stock prices and the economic situation became evident.

Following COVID-19, with countries implementing lockdown policies and strict isolation measures, coupled with the impact of the pandemic on various industries, increased unemployment rates and slower-than-expected economic growth became prominent. In the first quarter of 2020, the U.S. GDP contracted by 4.8%, marking its first decline since Q1 2014. Concurrently, the GDP of the Eurozone also contracted by 3.8%, representing the largest contraction in history.

Government Market Rescue Actions:

Following the outbreak of the COVID-19 crisis, the Federal Reserve in the United States, to rescue the market, implemented a zero-interest-rate policy coupled with an unlimited quantitative easing monetary policy.

On March 25, the U.S. White House reached an agreement with the Senate to disburse a $2 trillion relief package to individuals and businesses, marking the largest single economic stimulus package in U.S. history. Upon the announcement of this package, all three major U.S. stock indices saw an increase on the same day.

While this unprecedented and massive printing of money successfully rescued the stock market, it also raised concerns about global inflation.

Summary: Why Stock Market Crashes Happen and What to Do When They Occur?

Stock market crashes can be caused by economic recessions, human factors, or even unforeseen events. However, their commonality lies in the difficulty of predicting the timing and duration of their occurrence.

Throughout one’s life, it’s inevitable to experience several stock market crashes. Everyone must learn to coexist with these crashes, and through asset allocation, effectively reduce the risk of significant market fluctuations. The more diverse the investment portfolio, the more likely it is to survive when the primary assets decline.

As Warren Buffett firmly believes, stock market crashes, like natural disasters, are temporary and will eventually return to normal. The stock prices of held companies will ultimately reflect their intrinsic value. When a stock market crash occurs, it presents a great opportunity to buy good companies at low prices.