Morning review:

Dear friends, I am Don Adam Perera, and I am very pleased to be with you all in our community today. Today, we will explore the trajectory of the stock market, identify new wealth hotspots, and continue to optimize our investment portfolios in hopes of achieving steady profit returns.

1.What economic data and events do we need to pay attention to today?

2.How are the stocks in our investment portfolio performing? How should we optimize?

3.There have been numerous data releases in the market this week; what strategies should we employ in our operations?

I will share content on the topics mentioned above.

Today, we need to closely monitor the following key economic data and major events to ensure our investment decisions align with the latest market dynamics:

1.The August ISM Manufacturing Employment Index, an important tool for measuring employment conditions in the manufacturing sector, which can provide us with signals about the stability of manufacturing employment. This is significant for assessing the overall health of the economy.

2.The upward revision of the University of Michigan’s final consumer confidence and the downward revision of inflation expectations indicate that the current economy is very resilient. Simultaneously, the reduction in inflation provides a good reference for the Federal Reserve to consider lowering interest rates.

3.Warren Buffett’s company has once again reduced its holdings in Bank of America stock, sending a signal of uncertainty to the market. This reminds us that we need to pay special attention to risk management in our operations this week to ensure stable profits.

4.Reports say that Elon Musk will meet with Italian Prime Minister Meloni on September 23 to discuss investments in space and AI. This meeting could positively affect the aerospace and artificial intelligence sectors, as well as stocks related to Musk, potentially driving their prices up.

Dear friends, although our market economy remains generally healthy, this week, with the release of several key economic data points, we expect some significant price fluctuations in the market. Particularly, the non-farm payroll data to be released this Friday could likely serve as an important reference for the Federal Reserve when deciding on rate cuts and adjusting policy pace.

The release of these economic indicators not only provides us with key information for analyzing market trends but also serves as a foundation for continuously optimizing our investment portfolios and formulating corresponding strategies.

The VIX 15-minute price trend shows a continuous rebound, reflecting that the current sentiment among market investors is very volatile, with even brief moments of panic leading to price pullbacks during the session. As I previously mentioned, with numerous economic data releases this week, significant market price fluctuations are a very normal occurrence.

In this situation, we need to adapt to the impact of brief price pullbacks caused by these significant price fluctuations. At this time, it is most crucial to adjust our mindset, maintain composure in the face of market volatility, and not be disturbed by short-term fluctuations. We must have enough patience and confidence in the market, especially against the backdrop of the Federal Reserve’s impending rate cuts, as any stock price pullback could provide us with excellent buying opportunities.

Now, let’s focus on the performance of stocks in our investment portfolio:

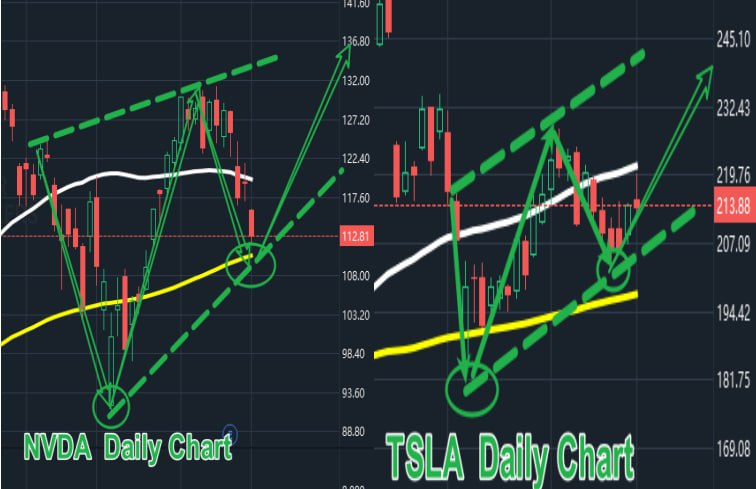

NVDA, as a leading stock in the artificial intelligence sector, has always been an important part of our investment portfolio. Although the strength of tech stocks may diminish, it will not disappear entirely. Recently, NVDA has indeed experienced some short-term price pullbacks, yet its overall trend direction remains solidly intact. The tech sector has long been a part of our long-term investment strategy, and short-term price fluctuations should not affect our holding decisions. The trend direction of NVDA has not changed, so at its current market position, I believe NVDA still merits our continued focus and maintaining our holdings.

TSLA’s overall trend direction remains upward. Currently, the price center has shifted upward, challenging the upper resistance levels once again. This represents the continued increase in the strength of a bullish rebound, indicating that TSLA’s trend direction is solid, and we can continue to look for opportunities to capitalize on rebounds.

MSTR, a stock associated with the cryptocurrency concept, has recently become a focal point for us. Given the anticipated broad positive impact of the forthcoming Federal Reserve rate cuts on the investment market, cryptocurrencies and related stocks, including MSTR, are expected to receive significant momentum.

Historical data indicates that the cryptocurrency market typically experiences a bull market within a year following a presidential election. Therefore, with the recent conclusion of the latest presidential election, we have reason to believe that the cryptocurrency market will see a strong rebound, and related stocks such as MSTR will benefit from this.

Technical chart analysis shows that MSTR has once again entered a rectangular pattern of trend movement. This pattern is typical of a market consolidation phase, and I will later share detailed information on how to utilize this pattern to identify buying and selling points.

NEM’s overall market trend has shown a continuous bullish rebound, which is a very healthy trend condition. In the current upward trend, NEM has demonstrated clear upward momentum, which itself suggests potential for further upward movement.

Although there is a brief pullback in prices currently, it does not affect our confidence in holding it. Furthermore, considering that tensions in the Middle East still carry uncertainties and global risk aversion remains high, gold, as a traditional safe-haven asset, typically performs even better in such an environment. Therefore, we will continue to hold stocks in the gold sector.

Today, the three major stock indices experienced significant pullbacks, not only affecting the market’s bullish sentiment but even triggering panic selling. In such circumstances, my steadfast view is that risk and opportunity always coexist. As the investment guru Mr. Warren Buffett said, “Be greedy when others are fearful.” Market risks often accumulate during uptrends, while opportunities usually arise during downturns.

In the current market environment, when many are selling due to panic, I believe it is an excellent opportunity to enter.

Dear friends, after continuous tracking and in-depth analysis, I have once again identified a high-quality stock with tremendous potential that is currently at a very ideal buying moment. I expect this stock’s profit potential to exceed 30%, so you can include this top pick in our investment portfolio today.

Today’s stock pick: Chipotle Mexican Grill (CMG) Fundamentals:

This company, based in Delaware, operates Chipotle Mexican Grill restaurants. These restaurants are renowned for offering dishes such as burritos, burrito bowls (a burrito without the tortilla), tacos, and salads. The company is committed to using ingredients from reliable sources, dedicated to cooking real food with classic techniques, and ensures the use of healthy ingredients without added artificial colors, flavors, or preservatives. The company not only provides customers with high-quality dining experiences but also focuses on nutritional quality.

From a financial perspective, the company has demonstrated impressive stability and growth potential. Its return on total assets is 17.07%, indicating stable profitability from its assets; the return on equity stands at 51.54%, reflecting its strong ability to deliver returns to shareholders. Additionally, the company has maintained steady growth in operating revenue and has significantly improved its ability to pay cash promptly.

This solid financial performance and commitment to sustainable, healthy business practices allow the company to stand out in a highly competitive market, providing significant value to both investors and customers. Therefore, you can consider participating in building a position with 10% of your portfolio.

In order to ensure that you are kept up to date in real time with the latest developments in the stocks in our portfolio, I strongly recommend sending the details of the stocks in which you have opened positions to my assistant. This way, the assistant can help you track the real-time movements of these stocks on a daily basis and ensure that you are notified in a timely manner when relevant actions need to be taken.

If you have any questions or need further assistance, please do not hesitate to contact my assistant!

Dear friends, the stocks in our portfolio can continue to be held for waiting, but this week many economic data will be released, which will cause severe price fluctuations in the stock market. Therefore, during our operations this week, we need to be mindful of the following considerations in our trading process:

1.Strictly control positions: It is recommended to keep the overall position around 50%. If the current holdings are too heavy, consider reducing positions appropriately to lessen the impact of market fluctuations on the investment portfolio.

2.In the face of severe market price fluctuations, we must remain calm, rational, and patient during our operations. It’s important not to let short-term price movements influence our decision-making process. Focus on the long-term investment value and strategies, rather than being swayed by transient market emotions.

3.Closely monitor economic data: Particularly, the non-farm payroll data to be released this Friday is an important indicator with far-reaching effects on the market. Based on the results of the released data, promptly adjust our trading strategies and optimize our investment portfolio to respond to potential market changes.

4.Adopt flexible trading strategies: Considering the potential for severe price fluctuations this week, we can combine short-term and medium-term trading strategies. For stocks with good trends that may be overvalued in the short term, consider reducing positions appropriately. Then, when stock prices pull back to key support levels, consider buying back the positions previously reduced.

Through such a cautious and flexible strategy, we can not only pursue profits but also effectively manage risks, protecting our investments from unforeseen market fluctuations.

Dear friends, this cautious and flexible strategy that we at New World Asset Management employ is one of the common methods used when optimizing asset allocation for our clients.

As a professional institution focused on quantitative financial investment, we have a team of 30 top investment experts and analysts, each with over 30 years of investment experience. These experts possess a broad global perspective, enabling them to monitor and analyze in real time the dynamics across multiple market sectors including stocks, foreign exchange, bonds, options, gold, and cryptocurrencies.

Our goal is to create comprehensive and diversified asset allocation strategies for investors, helping them achieve steady wealth growth and providing solid protection for their financial security through in-depth data research and market analysis.

Moreover, at New World Asset Management, we are committed to enhancing our social status and accumulating rich client resources while expanding our asset management scale within the global asset management industry. Our goal is to align ourselves with global leading asset management firms such as BlackRock, Vanguard Group, Morgan Stanley, and Fidelity Investments. To achieve this ambitious goal, we have set a vision to embark on the path to a NASDAQ listing within the next three years.

To further enhance the market recognition and influence of New World Asset Management, we have specially organized the 10th New World Quantitative 4.0 Financial Investment Training Course. This course is designed to comprehensively improve investors’ professional knowledge and trading practice abilities through systematic education and hands-on exercises, cultivating top performers in the financial investment market. We look forward to leveraging the success stories of our community members in the market to help effectively promote and publicize New World Asset Management, further boosting our market recognition and appeal. This requires the collective effort of all our community members.

Dear community friends, I hope everyone not only focuses on wealth opportunities but also deeply learns and masters various investment methods and techniques. Later, I will continue to share “How to accurately identify buying and selling points using rectangular patterns in stock trend movements.” See you later.

Closing commentary:

Dear friends, I am Don Adam Perera. This afternoon, we gathered in our community and spent a very special time together. In the face of significant market pullbacks, we did not retreat; instead, we bravely confronted this challenge together, exploring the causes of the market decline and developing strategies to optimize our investment portfolios.

1.What are the reasons for the stock market downturn?

2.How should we operate in the face of a significant market correction?

3.How should we select the best buying and selling points within a rectangular pattern in stock price trends?

I will be sharing on these topics.

In the investment market, policy always serves as our guiding beacon, while economic data acts as the barometer of the stock market. They not only indicate the current state of the market but also foreshadow future trends.

1.Today, the ISM reported August’s Manufacturing PMI at 47.2. Although this is an improvement from July’s 46.8, it still falls short of the market expectation of 47.5. Additionally, it’s worth noting that the August ISM Manufacturing New Orders Index further declined to 44.6, the lowest level since May 2023, and significantly below the previous value of 47.4.

These data reflect that manufacturing activity remains sluggish, and this continued weakness has heightened market concerns about a possible further economic downturn.

2.Sector-wise: The July sales data released by the Semiconductor Industry Association fell short of seasonal expectations, indicating that the overall market remains in a weakened state. The release of this data directly triggered widespread concerns about chip stocks, leading to a significant pullback in this sector.

These two factors have contributed to the significant pullback in the stock market today.

Today, we witnessed a significant pullback in the stock market, particularly in chip stocks, which undoubtedly triggered panic selling among investors. The VIX index, known as the barometer of market fear, shows a continuous rise in its 15-minute chart, clearly reflecting the intense fluctuations in investor sentiment and the widespread state of panic.

The essence of the stock market lies in the flow of capital. Under the current pressure and fear, panic selling has been triggered, which means capital outflows. When large-scale selling occurs, stock indices and prices naturally experience pullbacks. This is part of the dynamic balance of capital markets; a decrease in investor confidence directly impacts the value of stocks.

In the face of today’s significant market pullback, I understand that many of you may be feeling panicked and may have reacted by blindly selling your stocks. Such a reaction is understandable given human nature, but I believe the market’s response to today’s data may have been overly aggressive.

Considering the Federal Reserve’s impending rate cuts, this significant market pullback actually presents us with a better opportunity to buy high-quality stocks. For those who have already made early purchases, this kind of substantial pullback offers an excellent opportunity to increase your positions.

The significant pullback the stock market is currently experiencing should not be a source of concern for us but rather a moment of excitement to seize opportunities. Every market correction carries hidden opportunities, especially after a substantial pullback driven by panic.

I still hold a rebound perspective on the current performance of the stock market. Although today’s panic-driven sell-off led to a significant pullback in the three major indices, such a movement undoubtedly requires a period of recovery. During this recovery process, we should adopt an active strategy, gradually adding to positions and participating in trades to capture the upside potential as the market recovers. Therefore, I encourage everyone to remain calm and patient during this phase, and to approach market fluctuations with an open mindset.

In the face of the current sharp pullback in the market, we have decided to hold the stocks in our portfolio for now. Based on my judgment, I expect the stock market to show varying degrees of rebound tomorrow. Therefore, we plan to adopt a strategy to cover our positions based on the price running trend of tomorrow’s market.

Please pay close attention to what the community is sharing and get ready to capitalize on tomorrow’s investment opportunities. If you are worried about missing the best time to buy tomorrow, you can contact my assistant directly, who will make sure to notify you of the information in time Meanwhile, I will also explain our trading strategy one by one in tomorrow’s community sharing. Please be sure to follow the community sharing to make sure you don’t miss any important information.

In the time we have left, we will embark on a journey of exploring and learning investment methods and techniques together. Today, I will be sharing in-depth insights on “How to select buying and selling points within a rectangular pattern in stock market trends.”

A rectangular pattern is a common price consolidation range in the stock market, indicating that prices are hovering between two horizontal levels of support and resistance. This often reflects a wait-and-see attitude among market participants before making further decisions.

As shown in the chart, by observing NVDA’s daily trend from August 2023 to May 2024, we can clearly see it operating within a rectangular formation. This pattern demonstrates the price fluctuating within a defined range, indicating that the market is deciding on a direction during this period. It also highlights the importance of identifying support and resistance levels.

In this oscillating trend, the trading strategy typically involves buying low and selling high. Specifically for NVDA’s rectangular formation, support levels are found at points A and B, while resistance levels occur at points C, D, and E. During operations within this rectangular pattern, investors should buy at support levels and sell near resistance levels to capture profits.

The rectangular formation is not only a manifestation of price fluctuations but also crucial for determining future direction. Once the price successfully breaks through the upper or lower edge of the rectangle, this usually signals the establishment of a new trend direction. For example, at point F in the chart, once the price successfully breached this point, NVDA demonstrated a strong upward rebound trend.

I hope all my friends can learn and master this method of analyzing trend patterns. By accurately identifying and effectively utilizing these key market formations, we can not only improve our investment efficiency but also steadily increase our wealth in the stock market.

I trust that all the friends in our community have taken good notes and learned well. Tomorrow, I will be working with everyone in the community to find the most suitable buying points for premium stocks and the positions for adding to our investments.

Dear friends, the stock market is currently experiencing a temporary pullback, a challenge that we all must face together. This is a journey we are on together, and we need to move forward hand in hand at every step. I look forward to supporting each other with every one of you on this path, growing together, and sharing in our collective wealth story.

I look forward to seeing all my friends in tomorrow’s community share, where we will jointly search for the best positions to add to our holdings. See you tomorrow.